The idea to start the tenant screening process came to the co-founder Tenantify, who realized that the process stayed behind with the 20th century. For example, the most common practice in tenant screening is credit report. However, landlords often do not realize that a typical credit report from three major credit bureaus (TransUnion, Experian and Equifax) only indicates a tenant's long-term creditworthiness in the past 7 years. It says little about tenant's current employment status or his/her ability to pay rent. Some alert landlords request paper bank statements and pay slips to verify income, only to find that they need to watch out for fraudulent statements. Do they know that many websites offer bank statement templates for free?

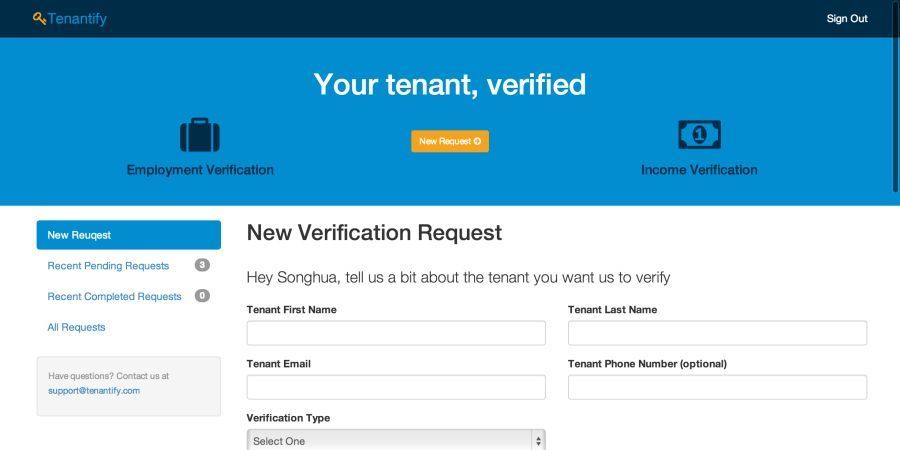

How Tenantify Verify Income? They need to deliver an authenticated bank statement from tenant to landlord conveniently, securely and without fraud risk and touching anyone's sensitive personal information. The partnership with DecisionLogic brings all the convenience and security. The service gives instant and only required information without saving any bank credentials.

How Tenantify Verify Employment? With tenant employment information (title, employer name, address, phone number) Tenantify verifies the info with trusted third-party sources (Yellow Page, Yelp, BBB, etc) and then directly talk to employer via a verified phone number to get positive or negative confirmation.

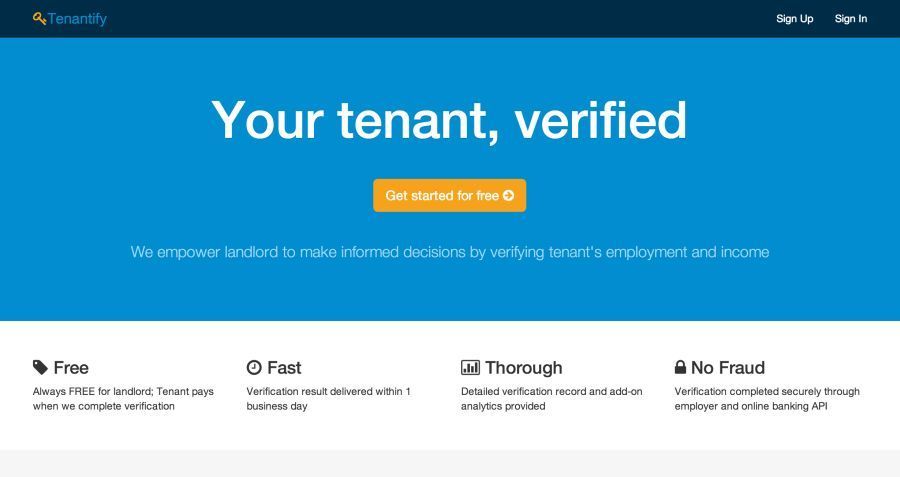

Tenantify services are free for landlord and becoming very popular in US. Tenant pays when detailed verification completes. While using tenant verification services depends on landlord preferences, it is great to take a look what Tenantify offers. They are here to empower every landlord, prevent froud and save time for both landlord and tenant. For more information please check Tenantify services on-line, you can also contact them support@tenantify.com with any questions.

This website and I conceive this internet site is really informative ! Keep on putting up!

ReplyDeletebackground check mumbai